Non Profit Donation Receipt

However there are certain specifications around the donation including cash limits and type of donation. Select the checkbox for the pledge then Save and send if you want to email your donor a receipt of the donation.

Nonprofit Donation Receipts Everything You Need To Know

9 Mistakes to Avoid When Giving Donation Receipts.

. Name of the Non-Profit Organization. Then if you need to you can also send the sales receipt to the donor as a. 7 Non-Profit Donation Receipt.

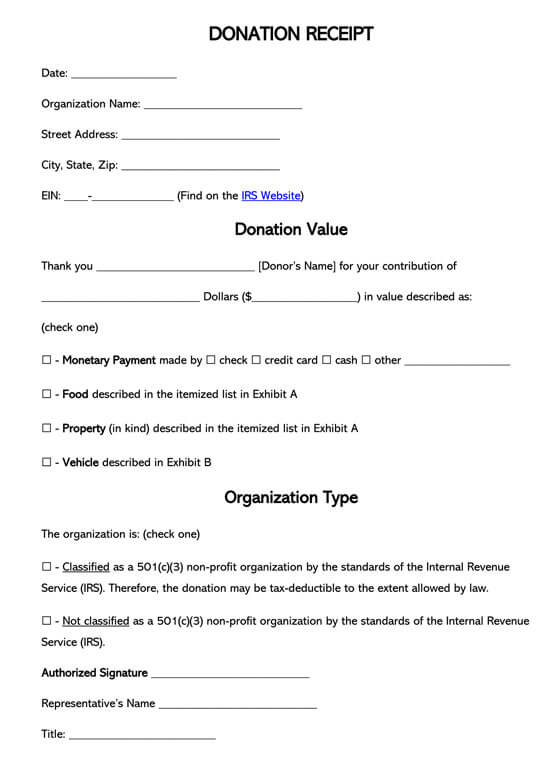

A great way to achieve this is by downloading a template. Please click on the button below to electronically track your donations. A statement that no goods or services were provided by the organization if applicable A description and good faith estimate of the value of goods or services if any that the organization provided in return for the contribution.

They provide a free pickup service that covers the greater New York and Tri-State Area. The receipt can be a letter a postcard an e-mail message or a form created for the purpose. It would be wiser.

Also if the donation was to an organisation that is not a registered deductible gift recipient then you cant claim it. Think Before You Donate - Defeating the Rumors. Goodwill Central Coast is a 501c3 non-profit organization Tax ID 94-1254638.

A nonprofit is subject to the non-distribution constraint. It doesnt matter whether the donation to one organization reaches the 250. We expertly handle all aspects of processing your used cars send the net sale proceeds to the charity and then you receive a tax-deductible receipt within 2.

8 Learn About the Legalities of Donation Receipts. 13020XX Date of letter to donor. The charity receiving this donation must automatically provide the donor with a.

A lot of non-profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the next year. Yes you may still qualify for the charitable donations deduction without a donation receipt. Get tips on starting and structuring your organization filing annual reports and more.

See how your mission can thrive as a nonprofit. This letter is your receipt for income tax purposes. There are many things you can do to make sure your receipt includes everything and still looks impressive.

Creating Your Fundraising Letters. For instance if the vehicle is worth more than 500 the non-profit must give you a detailed donation receipt known as Form 1098-C Contributions of Motor Vehicles Boats and Airplanes. With the usual and necessary caveat of I am not attorney nor am I giving legal advice I responded that Yes when the transaction advances the donor non-profits charitable mission a non-profit can donate money and other resources to another non-profit.

Sample 501c3 Donation Receipt DONATION RECEIPT. As a sales receipt. Our simple process makes it possible for more charities to benefit from the generosity of donors like you.

Make sure to select Non-Profit Income as the detail type. When you bring items to one of our donation locations you may fill out a paper donation form. Basically if you receive something because of your donation then dont claim the donation as a tax deduction.

Yes must be listed to confirm the entitys non-profit status. To get a good idea of what you can expect check out the American Cancer Societys Cars for a Cure program where youll get a better idea of what to expect. By providing receipts you let your donors know that their donation was received.

The IRS considers each donation separately. Call the 247 vehicle donation phone line at 866 233-8586. Instead of starting from a blank page with no guidance refer to samples of letters that.

Pickups can be arranged within 24 to 48 hours and free towing and a tax receipt will be provided. For more information on how to take a deduction scroll to the bottom of this page for a how-to video. Whether youre writing to request support of your organizations capital campaign or youre seeking sponsors for an upcoming special event - or raising money for some other purpose - an effective fundraising letter can be the difference between success and failure.

10 Tax Receipt for Donation. Goodwill 501c3 non-profit. You can call 212-229-0546.

This thrift shop on 17th Street in New York City raises funds to support substance abuse HIVAIDS and mental health programs as well as the Bridge2Life Camp Charles Evans Kids Club and the Pregnant Women Infants Program. What Are Donation Receipts. The statement On Publication 78 Data List.

This includes volunteer fire companies museums churches and nonprofit hospitals. A nonprofit organization NPO also known as a non-business entity not-for-profit organization or nonprofit institution is a legal entity organized and operated for a collective public or social benefit in contrast with an entity that operates as a business aiming to generate a profit for its owners. For more information or to make arrangements.

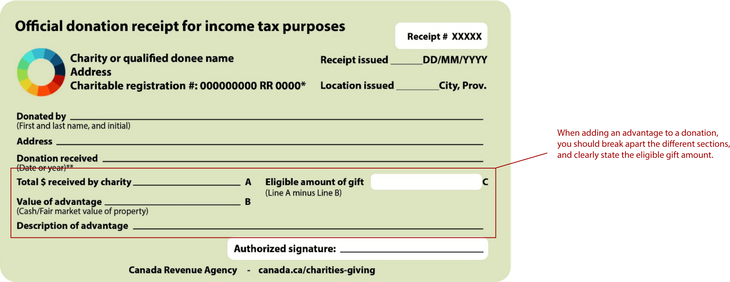

A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. The IRS considers a donation a gift given to an organization that qualifies for the 503c nonprofit status. In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction.

Angel Street Thrift Shop. Salvation Army 501c. Since donated clothing is often secondhand it is up to the donor to estimate the clothings values.

Any donations worth 250 or more must be recognized with a receipt. Non-Cash Property Contribution. Also make sure that your template for the non-profit donation receipt is both professional and versatile.

When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. I was asked if one 501c3 non-profit can give money to another 501c3 charity. With a template you can customize the perfect receipt for your organization.

HelpAge NGO India - A leading Non Profit Organization in India caring for disadvantaged elderly senior citizens for more than three decades. The donor estimates the value of non-cash contributions when reporting them to the IRS on his tax return. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their State andor Federal taxes.

Some people assume that gifts to a church are always tax deductible donations. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. To determine the fair market value of an item not on this list below use this.

Our donation value guide displays prices ranging from good to like-new. Thank you for your donation of describe donated services or use of facilities on January 24 20XX or during the period of January 1 20XX through June 30 20XX to Save Our Charities SOC in support. Goodwill Industries of Northern New England.

Any revenues that exceed. Goodwill Industries of Southeastern Wisconsin and Metropolitan Chicago is a 501c3 non-profit recognized by the IRS. Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition only on the date of the donation.

You can create a sales receipt if you receive the donation right away. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction.

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Free Donation Receipt Templates Silent Partner Software

Nonprofit Donation Receipt Letter Template

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free 501 C 3 Donation Receipt Templates Word Pdf

Why How And When To Issue Charitable Donation Receipts

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox